Read my reports

Now you can read my reports at my home page

Tomasz Ćwik

Direct link to MBA Cracow assignment reports

Oraz polska wersja: MBA Kraków prace zaliczeniowe

Performance Management - blog about performance old and new performance management tools. Blog as a record of Performance Management course at Cracow MBA University of Economics.

Now you can read my reports at my home page

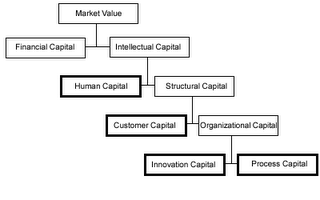

One of the first significant attempts of classifying and reporting the value of intellectual capital

took place in 1994 by the group of specialists of Swedish financial service firm Scandia. At that time Professor Leif Edvinson was appointed as a world first Intellectual Capital Director at Skandia AFS. In 1994, Skandia began to publish a series of intellectual capital supplements to its financial accounting statement.

took place in 1994 by the group of specialists of Swedish financial service firm Scandia. At that time Professor Leif Edvinson was appointed as a world first Intellectual Capital Director at Skandia AFS. In 1994, Skandia began to publish a series of intellectual capital supplements to its financial accounting statement.

It is now commonly accepted that we are in the midst of a new phase of evolution in the major global economies, which is characterized by new performance and value drivers that are mainly intangible. So-called intangible or knowledge economy is the new environment that companies have to learn to cope with. During the last two decades most industrialised economies have progressively moved towards a knowledge-based rapidly changing economy where investments in human resources, information technology, R&D and advertising have become essential in order to strengthen a firm’s competitive position and ensure its future viability.

“What you measure is what you manage” says one of the most famous performance truisms. Taking it into consideration organizations implement more and more sophisticated methods of measuring and managing of their performance. Among years that systems has evaluated becoming much more detailed providing standardised set of information to their recipients